📘 Download the New Free E-Book

-

How to Automate Accounting in 2025

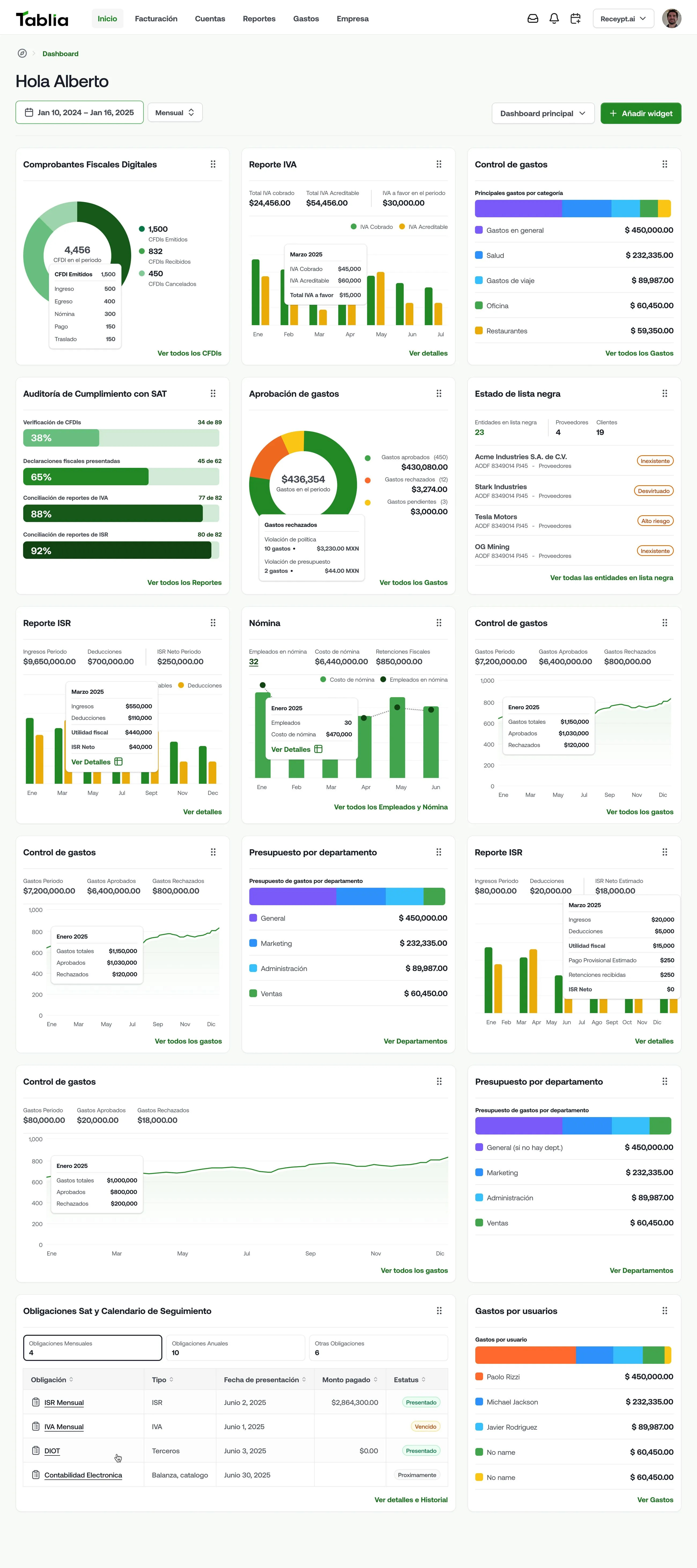

Automate your operations, simplify accounting processes, and ensure tax compliance. With a direct connection to SAT and intelligent reconciliation tools, Tablia streamlines financial decisions for your business.

Tablia takes your accounting to a new era.

It automates everything from SAT connection to bank reconciliation, eliminating repetitive tasks and giving you full control with real-time, accurate data.

Automatic SAT connection and CFDI retrieval.

AI-assisted declarations and report generation.

Smart journal entries and rules engine to verify and optimize your operations

AI-powered transaction categorization.

Dynamic reports for income, expenses, taxes, and cash flow.

Dashboard with key metrics (recoverable VAT, balances, financial status).

Detection of anomalies, blacklists, and uncategorized expenses.

Bank and account statement integration for complete transaction monitoring.

Automatic synchronization of all CFDIs related to your company.

AI-assisted tax filings (VAT, income tax, withholdings, DIOT)

Real-time validation of clients, vendors, and invoices.

Alerts and reminders for key tax deadlines.

Tablia transforms the way you manage your company’s finances. From setup in 5 minutes to fully automated accounting processes.

Automate reconciliation and entries with AI. Reduce closing time from days to hours.

Invite colleagues, review in real time, and maintain traceability.

Automate your obligations and receive alerts before deadlines.

No complex setups or endless configurations. Connect your SAT and bank in minutes.

Tablia grows with you.

From small businesses to accounting firms handling hundreds of clients, our platform provides the automation and insights you need to scale.

Learn step by step how to connect to the SAT and optimize your reports.

Learn everything about tax obligations, deductions, and SAT updates they never taught you.